A comprehensive guide of property taxes in New Jersey, before buying your dream home, better equip yourself with this knowledge first. For more details, please read the information below.

Effective Real Estate Tax Rate in New Jersey

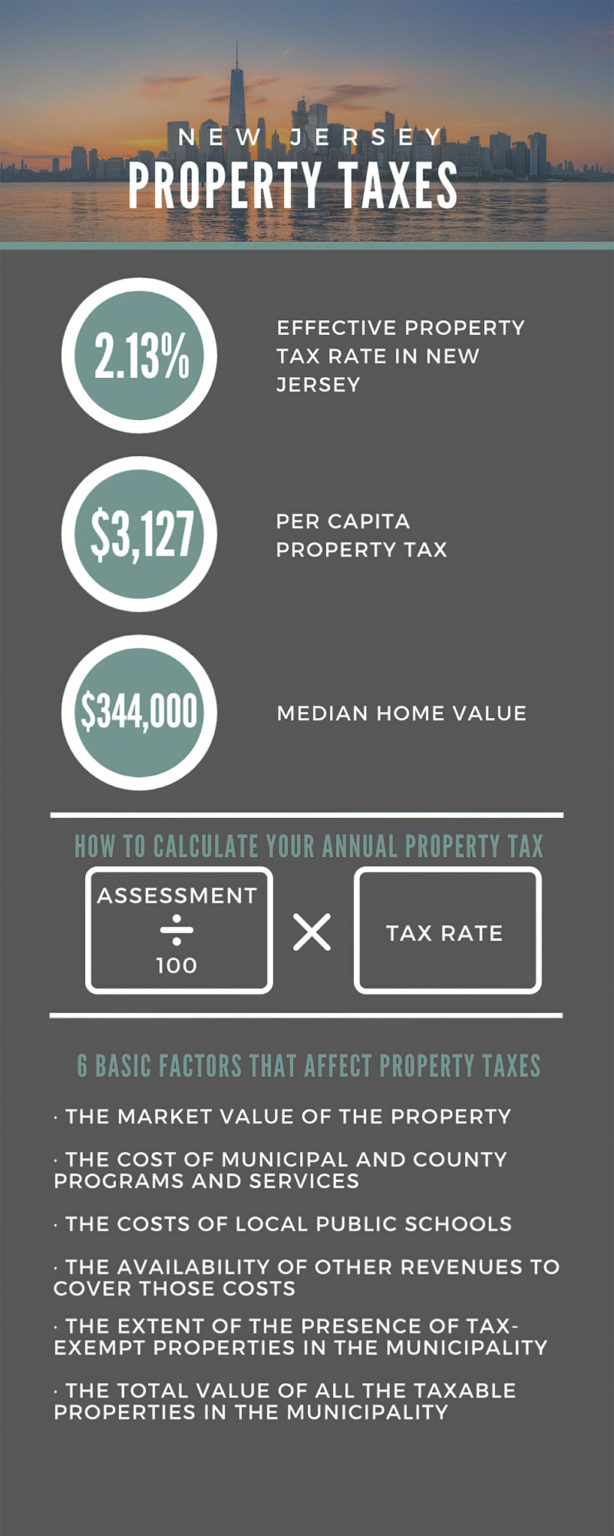

In New Jersey, the effective property tax rate is 2.13%, which is the highest in the nation. Does this mean that it’s buying a home in the Garden State is a bad idea? Quite the opposite. In fact, New Jersey’s real estate market is hot, meaning it’s a seller’s market and homebuyers are often willing to pay more than the list price. The median home value in New Jersey is $336,389, up 1.6% over the past year, and the median list price per square foot is $193. The median sale price of houses that are currently listed is $340,000 while the median price of homes that sold is $294,800.

6 Basic Factors That Affect Property Taxes

According to the New Jersey League of Municipalities, New Jersey’s tax system is determined by six basic factors:

-

- The market value of the property

- The cost of municipal and county programs and services

- The costs of local public schools

- The availability of other revenues to cover those costs

- The extent of the presence of tax-exempt properties in the municipality

- The total value of all the taxable properties in the municipality

The group further explains how each of these factors affect one’s property tax bill. For one, if a homeowner’s property increases in value because of structural additions or renovations, then their tax liability also increases. When a property’s value increases beyond average appreciation, it consequently represents a larger portion of the value of the municipality and is then assigned a larger portion of the “amount to be raised through property taxation”. When the costs to deliver local government services and programs are higher, this also translates to higher property taxes. The same goes for local public schools – the higher the costs to educate students in the local school district, the bigger the tax liabilities.

New Jersey’s Property Tax Rate vs. Other States

In the state of New Jersey, property tax accounts for over 40% of total state and local tax revenue, while the national average is just slightly above 30%. The effective property tax rate of 2.13% in the Garden State is the highest in the nation, followed by Illinois at 1.95%, New Hampshire at 1.94%, Vermont at 1.79%, and Connecticut at 1.68%. Effective property tax rate is defined as the total amount of property taxes paid annually as a percentage of the total value of all occupied homes in the state. Per capita property tax (average tax paid by residents in the state) is $3,127 and the median home value of the state is $344,000, which is the 6th highest in the nation. In comparison, the state with the 2nd highest per capita property tax is New Hampshire, at $3,115, and a median home value of $270,000, which is the 16th highest in the country. Connecticut has the 3rd highest per capita property taxes at $2,927, with a median home value of $277,400, which is the 13th highest in the nation.

Local Property Tax Assessment Process in New Jersey

Property tax is a local tax and, as such, this is assessed and collected locally to support municipal and county governments, as well as local school districts in New Jersey. While this tax does not directly support the state government, a large portion of this is used to support the functions that the state of New Jersey has imposed on local units.

Under the state constitution, New Jersey county assessors are mandated to calculate property taxes using the same laws and rules for everyone. Prior to generating a tax bill, assessors would need to establish the sale price of all taxable property within their jurisdiction, with the exception of farmland. Property taxes are then assessed in every county in the state based on 100 % of such value and these are assessed at the same time each year. In the state of New Jersey, taxes on real property are assessed on the first day of October of the year prior the first installment of the tax bill. Homeowners’ are to pay their property tax bill in four installments, which are due on the first days of February, May, August, and November.

To determine your tax bill, New Jersey county assessors would need to verify your property’s market value. This type of tax is called an ad valorem tax, taking into consideration the value of your home and is based on an estimated price a homebuyer would likely be willing to pay for your property on October 1. Aside from your property’s market value, assessors also take into consideration the cost of providing municipal and county services as well as public education when determining your tax bill. When calculating property tax, the assessor’s office sums up the market value of all taxable real property in the county, then the total cost of public programs is divided by this amount to arrive at the general tax rate which is multiplied by your property’s value to determine your individual property tax.

If you do not agree with your tax bill, you may file an appeal by April 1 or within 45 days after your assessment notification has been mailed to you, whichever is later. In localities where a district-wide reassessment has been made, you have until May 1 to appeal your tax bill. In general, appeals are filed at the county’s tax board, but if your assessment amounts to more than $1 million, you will need to file your request with the New Jersey state tax court.

For more information about property taxes in New Jersey, or if you have other concerns regarding this matter, you can click on this link or go to their website: www.nj.gov.

Local Property Tax Assessment Process in New Jersey

To determine your tax bill, New Jersey county assessors would need to verify your property’s market value. This type of tax is called an ad valorem tax, taking into consideration the value of your home and is based on an estimated price a homebuyer would likely be willing to pay for your property on October 1. Aside from your property’s market value, assessors also take into consideration the cost of providing municipal and county services as well as public education when determining your tax bill. When calculating property tax, the assessor’s office sums up the market value of all taxable real property in the county, then the total cost of public programs is divided by this amount to arrive at the general tax rate which is multiplied by your property’s value to determine your individual property tax.

If you do not agree with your tax bill, you may file an appeal by April 1 or within 45 days after your assessment notification has been mailed to you, whichever is later. In localities where a district-wide reassessment has been made, you have until May 1 to appeal your tax bill. In general, appeals are filed at the county’s tax board, but if your assessment amounts to more than $1 million, you will need to file your request with the New Jersey state tax court.

For more information about property taxes in New Jersey, or if you have other concerns regarding this matter, you can click on this link or go to their website: www.nj.gov.

By submitting information, I am providing my express written consent to be contacted by representatives of this website through a live agent, artificial or prerecorded voice, and automated SMS text at my residential or cellular number, dialed manually or by autodialer, by email, and mail.

By submitting information, I am providing my express written consent to be contacted by representatives of this website through a live agent, artificial or prerecorded voice, and automated SMS text at my residential or cellular number, dialed manually or by autodialer, by email, and mail.